Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The absorption chillers market attained a value of USD 1.46 Billion in 2025. The market is expected to grow at a CAGR of 4.00% during the forecast period of 2026-2035. By 2035, the market is expected to reach USD 2.16 Billion.

With global net zero commitments, absorption chillers are increasingly adopted to reduce electricity usage by leveraging low grade heat from waste, solar or biomass. Their lower carbon footprint and cost effective performance align with government sustainability mandates and corporate ESG goals. Subsidies and incentives for green cooling further accelerate deployment. Growing emphasis on Scope 1 and Scope 2 emission reductions by corporations is pushing industries to adopt low-carbon technologies, driving the market growth.

The absorption chillers market outlook is impacted by rising integration with building management systems (BMS), IoT sensors, and AI enables remote diagnostics, predictive maintenance, and optimized chiller performance. Smart chillers also reduce downtime and operating costs while improving efficiency. For instance, in August 2024, Avigna.AI unveiled a smart absorption chiller embedded with IoT sensors and seamless BMS integration. Furthermore, cloud-based platforms enable centralized control across multiple facilities, making them especially valuable for large enterprises, smart cities, and campus environments.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

4%

Value in USD Billion

2026-2035

*this image is indicative*

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

| Global Absorption Chillers Market Report Summary | Description | Value |

| Base Year | USD Billion | 2025 |

| Historical Period | USD Billion | 2019-2025 |

| Forecast Period | USD Billion | 2026-2035 |

| Market Size 2025 | USD Billion | 1.46 |

| Market Size 2035 | USD Billion | 2.16 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 4.00% |

| CAGR 2026-2035 - Market by Region | Asia Pacific | 5.2% |

| CAGR 2026-2035 - Market by Country | India | 5.9% |

| CAGR 2026-2035 - Market by Country | UK | 4.9% |

| CAGR 2026-2035 - Market by Refrigerant Type | Lithium Bromide | 4.4% |

| CAGR 2026-2035 - Market by End Use | Industrial | 4.5% |

| Market Share by Country 2025 | India | 7.5% |

Rapid urbanization and industrialization in Asia, Africa, and South America are fuelling infrastructure investments, adding to the absorption chillers industry revenue. According to the Asian Development Bank, over 55% of Asia’s population will be urban by 2030. Government programs and awareness of efficient cooling drive adoption of absorption chillers in new residential, commercial, and industrial projects.

Industrial sectors, such as petrochemicals, cement, food processing, and power generation generate abundant waste heat, which absorption chillers can convert into cooling. This dual utility lowers energy consumption, improves overall process efficiency, and enhances environmental performance in ESG driven operations. Furthermore, absorption chillers help industries meet stricter environmental regulations by reducing reliance on electrically driven compressors and minimizing refrigerant-related emissions.

Explosive expansion of hyperscale and colocation data centres worldwide is driving the absorption chillers demand for high capacity cooling. In March 2025, Johnson Controls launched the YORK® YVAM Air cooled Magnetic Bearing Chiller in Europe for hyperscale and colocation data centres to offer up to 40% lower annual power use. Absorption chillers also offer reliability, energy efficiency, and scalability, especially in regions with waste heat or onsite thermal sources, making them attractive for large data centre operators.

Manufacturers are introducing double effect and triple effect absorption chillers that significantly improve COP and energy utilization. New materials and designs also boost performance, while modular systems offer flexibility for diverse applications. For instance, Panasonic’s hot water absorption chillers, using water as refrigerant, eliminate fluorocarbons entirely and consume just 4% of the power required by electric chillers.

Policies promoting lower GHG emissions, energy efficiency, and green construction, such as LEED and ENERGY STAR provide financial incentives and mandates. This regulatory environment is encouraging end-users to choose absorption chillers over conventional systems. In July 2023, the Inflation Reduction Act (IRA) expanded tax credits and incentives to accelerate adoption of energy-efficient, low-carbon, and renewable technologies. With this, companies are prioritizing technologies in sustainability-linked projects, further accelerating their adoption across new builds and retrofits in both the public and private sectors.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Absorption Chillers Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Refrigerant Type

Key Insight: Ammonia-based absorption chillers are widely used in industrial and commercial sectors due to their high thermodynamic efficiency and zero ozone depletion potential. Ammonia acts as a natural refrigerant with a GWP of zero, making it ideal for facilities focused on sustainability. In February 2025, Star Refrigeration launched Azanechiller 3.0, an ultra-low-charge ammonia chiller offering high efficiency, reduced emissions, and industrial cooling versatility. These systems are especially common in food processing, breweries, and cold storage, where ammonia infrastructure already exists.

Market Breakup by Technology

Key Insight: Single-stage absorption chillers industry revenue is growing, driven by low-temperature heat sources such as hot water or low-pressure steam. These are best suited for smaller capacity cooling applications and are ideal for use in solar-assisted cooling, district heating networks, and combined heat and power systems. They are most efficient when waste heat is readily available but of lower grade. Panasonic and Ebara offer single-effect models optimized for hot water input and clean room environments, often used in hospitals or labs.

Market Breakup by Source of Energy

Key Insight: Gas fired absorption chillers use natural gas or biogas as the primary heat source, offering reliable cooling independent of electricity grids. These are widely adopted in areas with cheap gas supply or frequent power outages, especially in commercial buildings and remote industrial facilities. For instance, the Flue-Gas Fired Absorption Chiller by Shuangliang Eco-Energy uses waste heat from flue gas to produce cooling. They are also particularly effective in district cooling, shopping malls, and hospitals where stable cooling is critical.

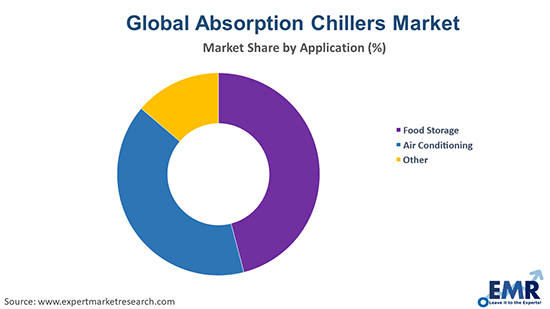

Market Breakup by Application

Key Insight: In food storage applications, the absorption chillers industry share is expanding due to the ability to operate reliably in low-temperature ranges, critical for preserving meat, dairy, and perishables. In 2025, Yazaki Energy Systems introduced its enhanced absorption chiller system, the WFC-M100 and WFC-MB100 models. Their ability to operate with waste heat from industrial processes makes them cost-effective in integrated food manufacturing units. Moreover, they meet HACCP and food safety standards, providing a clean, efficient, and sustainable cooling solution for the growing global cold storage industry.

Market Breakup by End Use

Key Insight: The domestic use of absorption chillers is rising in luxury villas, smart homes, and off-grid houses, especially in areas with abundant solar energy. Small-scale lithium bromide or water-based absorption units powered by solar hot water or biomass are emerging in Japan, Germany, and India. These systems offer silent, clean, and cost-effective cooling, especially in eco-housing projects where grid independence is prioritized. Manufacturers like Yazaki have compact absorption models specifically designed for residential HVAC, especially in net-zero energy homes where environmental credentials matter to both developers and homeowners.

Market Breakup by Region

Key Insight: Asia Pacific leads the global absorption chillers market, driven by rapid industrialization, urban expansion, and strong emphasis on energy-efficient infrastructure in China, India, Japan, and South Korea. For instance, India’s ADEETIE scheme, with ₹1,000 crore funding, promotes advanced energy-efficient technologies in MSMEs to boost sustainability and reduce costs. Government incentives for low-carbon cooling, expanding district cooling networks, and waste heat utilization in power and cement sectors further fuel adoption. Integration with solar thermal systems in India and Japan is also on the rise, especially in eco-cities and green-certified commercial buildings.

| CAGR 2026-2035 - Market by | Country |

| India | 5.9% |

| UK | 4.9% |

| Australia | 3.5% |

| Japan | 3.1% |

| Germany | 2.6% |

| USA | XX% |

| Canada | XX% |

| France | XX% |

| Italy | 2.0% |

| China | XX% |

| Saudi Arabia | XX% |

| Brazil | XX% |

| Mexico | XX% |

Lithium Bromide Absorption Chillers to Gain Popularity

Lithium bromide absorption chillers dominate commercial and HVAC applications, primarily using water as the refrigerant and lithium bromide as the absorbent. They are best suited for medium to large buildings, such as hotels, hospitals, and universities, where chilled water is required for comfort cooling. These chillers are also favoured for their silent operation, low maintenance, and compatibility with waste heat, steam, or solar energy sources.

Surging Deployment for Double Stage Absorption Chillers

The double stage segment is driving the absorption chillers market outlook due to rising prevalence in industrial facilities, large commercial campuses, and data centres. Companies like Carrier, Johnson Controls, and Thermax have released direct-fired and steam-fired double-effect chillers that reduce emissions and energy usage significantly. They are increasingly paired with IoT and AI for adaptive performance management in mission-critical infrastructure.

Steam Heated & Direct Fired Absorption Chillers to Accrue Preference

Steam-heated chillers utilize waste steam from industrial processes, boilers, or power plants, making them highly efficient in co-generation and CHP setups. These systems reduce both cooling costs and emissions by recovering energy that would otherwise be wasted. For example, Thermax and Shuangliang Eco-Energy provide double-effect steam-fired chillers used in refineries, paper mills, and power generation facilities. Their integration with building automation systems allows optimized performance.

Direct-fired absorption chillers demand is growing as they are ideal for standalone cooling where waste heat or steam is unavailable. These systems are particularly common in hotel chains, universities, and commercial complexes. Carrier, Yazaki, and Johnson Controls offer compact direct-fired lithium bromide chillers that can be installed with minimal infrastructure changes. They are also used as a primary cooling source in off-grid or energy-secure zones, where control and independence from local utility providers is essential.

Air Conditioning to boost Absorption Chillers Adoption

Absorption chillers are widely used in air conditioning applications for large buildings like airports, malls, hospitals, and office complexes, especially in regions with high energy costs or limited power infrastructure. In July 2024, Panasonic began demonstrating its novel absorption chiller for air conditioning, powered by hot water at just 70 °C sourced from hydrogen fuel cell generators. Lithium bromide-based systems are popular due to their efficiency, quiet operation, and compatibility with district cooling and cogeneration systems.

Booming Absorption Chillers Demand in Industrial & Commercial Sectors

The industrial sector is shaping the absorption chillers market trends, driven by the need to utilize process heat efficiently. The oil & gas, chemicals, pulp & paper, cement, and power generation sectors deploy large-scale systems to convert waste heat into useful cooling, improving overall plant efficiency and ESG performance. These systems also integrate with plant-wide energy management systems, helping industrial players comply with regulatory standards and carbon disclosure frameworks.

In the commercial segment, absorption chillers are used for centralized cooling, especially in buildings seeking LEED, WELL, or BREEAM certifications. Adoption is highest in Middle East, Europe, and Asia, where government policies and utility subsidies promote green construction. In May 2024, Carrier launched a Made-in-India scroll chiller, tailored for India's climate, offering efficient, reliable cooling for commercial buildings. These chillers are also used in district cooling networks, enabling efficient, shared cooling infrastructure across urban developments.

Europe & North America to Drive Absorption Chillers Usage

The absorption chillers market share in Europe is driven by strict environmental regulations, carbon neutrality goals, and widespread adoption of renewable energy in building systems. Absorption chillers are increasingly used in district heating and cooling, especially in Germany, France, Italy, and Scandinavia. In June 2025, CyrusOne and E.ON partnered to launch a 61 MW on-site gas‑fired power system, delivering absorption‑chiller cooling in Frankfurt. The EU Green Deal and REPowerEU plan support absorption technology, particularly in retrofitting public and commercial buildings with waste heat recovery systems.

North America is experiencing steady growth, particularly in data centres, hospitals, and university campuses seeking sustainable cooling. The U.S. Inflation Reduction Act (IRA) offers tax incentives that now include absorption chillers in green building upgrades. Adoption is rising in California, Texas, and New York, where decarbonization mandates and high electricity costs favour gas or steam-driven cooling. Johnson Controls, Carrier, and Yazaki are active players offering smart, low-emission systems.

Key players in the absorption chillers market are focusing on technological innovation, energy efficiency, and strategic partnerships. Leading companies are heavily investing in research and development to create advanced chillers with improved COP, lower emissions, and compatibility with renewable energy sources. Emphasis is placed on eco-friendly refrigerants and sustainable cooling solutions to meet stringent environmental regulations. Market players are also expanding their global footprint through mergers, acquisitions, and strategic alliances to enhance their product portfolios and strengthen distribution networks.

Partnerships with HVAC service providers and engineering firms help in securing large commercial and industrial contracts. Additionally, customization of products to meet industry-specific requirements is gaining traction. Digital integration is another emerging focus, with companies incorporating IoT and smart controls to offer predictive maintenance, energy monitoring, and improved system performance. Government incentives for energy-efficient systems are also prompting players to target developing regions with cost-effective solutions.

Founded in 1915 and headquartered in Palm Beach Gardens, the United States, Carrier is a pioneer in HVAC technologies. Carrier emphasizes innovation in energy-efficient chillers, smart building integration, and environmentally responsible refrigerants to support global decarbonization goals.

Established in 1966, Thermax Limited is headquartered in Pune, India. Renowned for its eco-friendly engineering solutions, Thermax specializes in absorption chillers powered by waste heat. It has introduced high-efficiency vapor absorption machines and is recognized for its role in advancing clean energy technologies across industrial and commercial sectors.

Founded in 1958 and based in Pune, India, Kirloskar Pneumatic excels in engineering products like compressors and refrigeration systems. The company is known for manufacturing robust and efficient absorption chillers suited for industrial use. It continuously innovates in thermal systems, emphasizing reliability, performance, and sustainable operations.

Formed in 2015 as a joint venture between Johnson Controls and Hitachi Appliances, the company is headquartered in Tokyo, Japan. It delivers advanced HVAC solutions, including absorption chillers with cutting-edge inverter and control technologies. The brand is recognized for integrating AI-driven energy management into its cooling systems for optimal efficiency.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other players in the absorption chillers market are LG Electronics, Trane Technologies Company, LLC, and ROBUR S.p.A, among others.

Unlock valuable insights into the absorption chillers market trends 2026 and beyond. Download a free sample report today to explore detailed forecasts, emerging technologies, and key player strategies. Stay ahead of the curve in this energy-efficient cooling revolution by accessing trusted, expert-backed data tailored for your business growth.

Italy Chiller Market

Germany Chiller Market

Japan Chiller Market

United Kingdom Chiller Market

United States Chiller Market

India Chiller Market

Philippines Chiller Market

Singapore Chiller Market

North America Chiller Market

South Korea Chiller Market

Europe Chiller Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market reached an approximate value of USD 1.46 Billion.

The market is projected to grow at a CAGR of 4.00% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach about USD 2.16 Billion by 2035.

Key strategies driving the market include integration with smart systems, use of low-grade heat sources, product innovation, partnerships, energy efficiency mandates, green certifications, and industrial waste heat utilization.

The key trends guiding the market include the growing eco-consciousness and rising demand for absorption chillers to reduce energy and operating costs.

The major regions in the market are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

The leading refrigerant types in the market are ammonia and lithium bromide.

The major technologies considered in the market report include single stage and double stage, among others.

The significant sources of energy in the market are gas fired, steam heated, direct fired, and hot water heated, among others.

The various applications of absorption chillers in the market are food storage and air conditioning, among others.

The significant end uses of absorption chillers include domestic, industrial, and commercial.

The key players in the market report include Carrier Global Corporation, Thermax Limited., Kirloskar Pneumatic Company Ltd., Johnson Controls-Hitachi Air Conditioning, LG Electronics, Trane Technologies Company, LLC, and ROBUR S.p.A, among others.

Asia Pacific dominates the market led by rapid industrialization, urban expansion, and strong emphasis on energy-efficient infrastructure in China, India, Japan, and South Korea.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Refrigerant Type |

|

| Breakup by Technology |

|

| Breakup by Source of Energy |

|

| Breakup by Application |

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share